Dubai - A Contrarian Bubble: Fresh Analysis

Over the past couple of years, property prices in Dubai have seen a significant increase, with the average market value rising by 23% since October 2021. With these changes, a common question arises: could this surging market be a sign of a bubble, and if so, when might it burst?

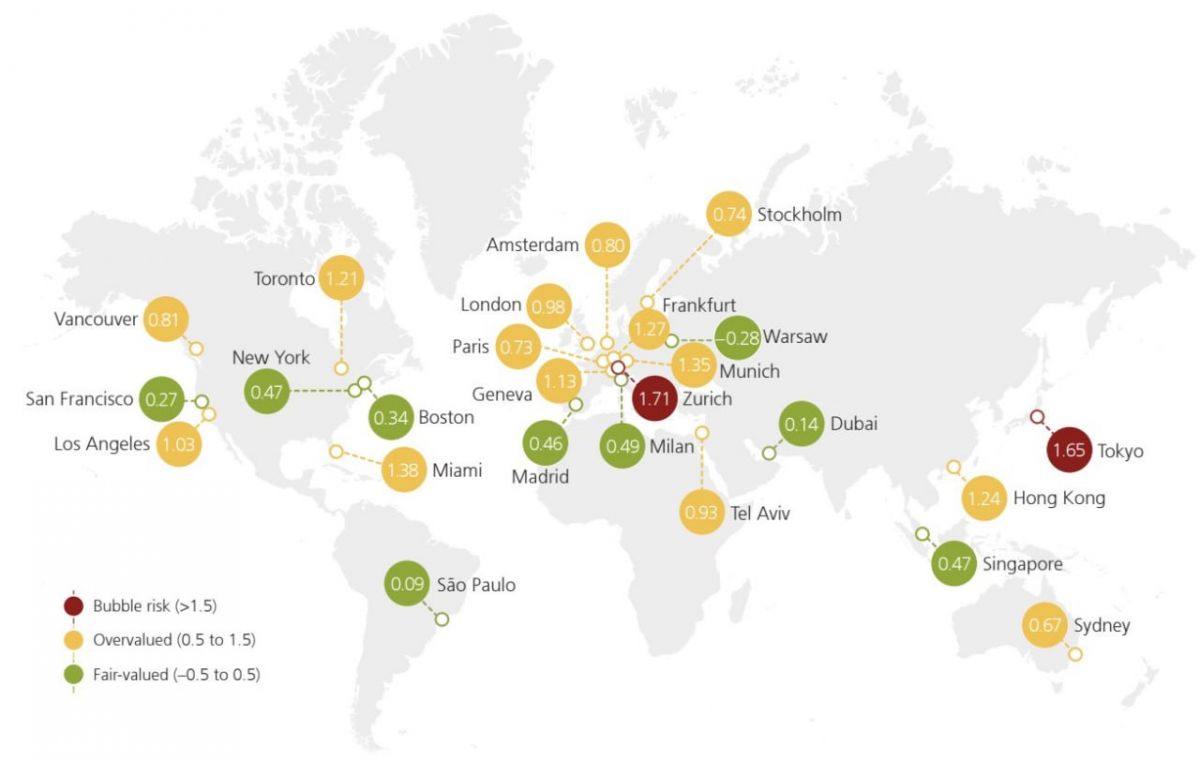

In late September, the annual UBS Global Real Estate Bubble Index was released - the most renowned international "bubble index." According to the report, Dubai's real estate market continues to be one of the most undervalued in the world.

For comparison, bubble index scores for other global cities are as follows:

Hong Kong: -1.24

Paris: 0.73

Dubai: 0.14

This report indicates that the rising property prices in Dubai are not indicative of a bubble formation. On the contrary, Dubai's real estate market remains stable and resilient.

This significant market analysis underscores that Dubai offers unique opportunities for real estate investment, promising continued growth and stability in the future.

We present engaging infographics from the report for a more in-depth analysis.

Keywords: Dubai, exception, rules, analysis, property, market, investments, housing, economy, emirate, construction, growth, trends, prices, demand, supply, infrastructure, projects, business, foreign investors, dollar, currency, location, Middle East, tourism, visa policy, taxes, legalization, innovation, urban environment, modernity, stability, affluence, quality of life, luxury, profitability, rental, skyscrapers, palm islands, entertainment, purchase, prestige, architecture, business centers, security, multiculturalism, infrastructure projects, sustainability index, real estate ranking, prospects